There are 191,000 consumers in the Fayetteville area who own their own homes.

There are 191,000 consumers in the Fayetteville area who own their own homes.

According to Zillow, more than 60% of homeowners carry a mortgage. A record number of owners are considering refinancing now, which means millions of dollars in fees for local lenders and brokers are up for grabs.

Why the sudden urgency for Fayetteville homeowners to refinance their mortgages?

According to The Federal Home Loan Mortgage Corporation (aka, Freddie Mac), "The average 30-year fixed-rate mortgage hit a record 3.29% this week, the lowest level in its nearly 50-year history."

"Meanwhile, mortgage applications increased 10 percent last week from one year ago and show no signs of slowing down. Given these strong indicators in rates and sales, as well as recent increases in new construction, it’s clear the housing market continues to be a positive force for the broader economy."

If a consumer Googles 'refinance my mortgage in Fayeteville', more than 2.6 million results come back, So, to set themselves apart, lenders and brokers will need to advertise. By any key metric, advertising on local radio is the best way to reach area homeowners.

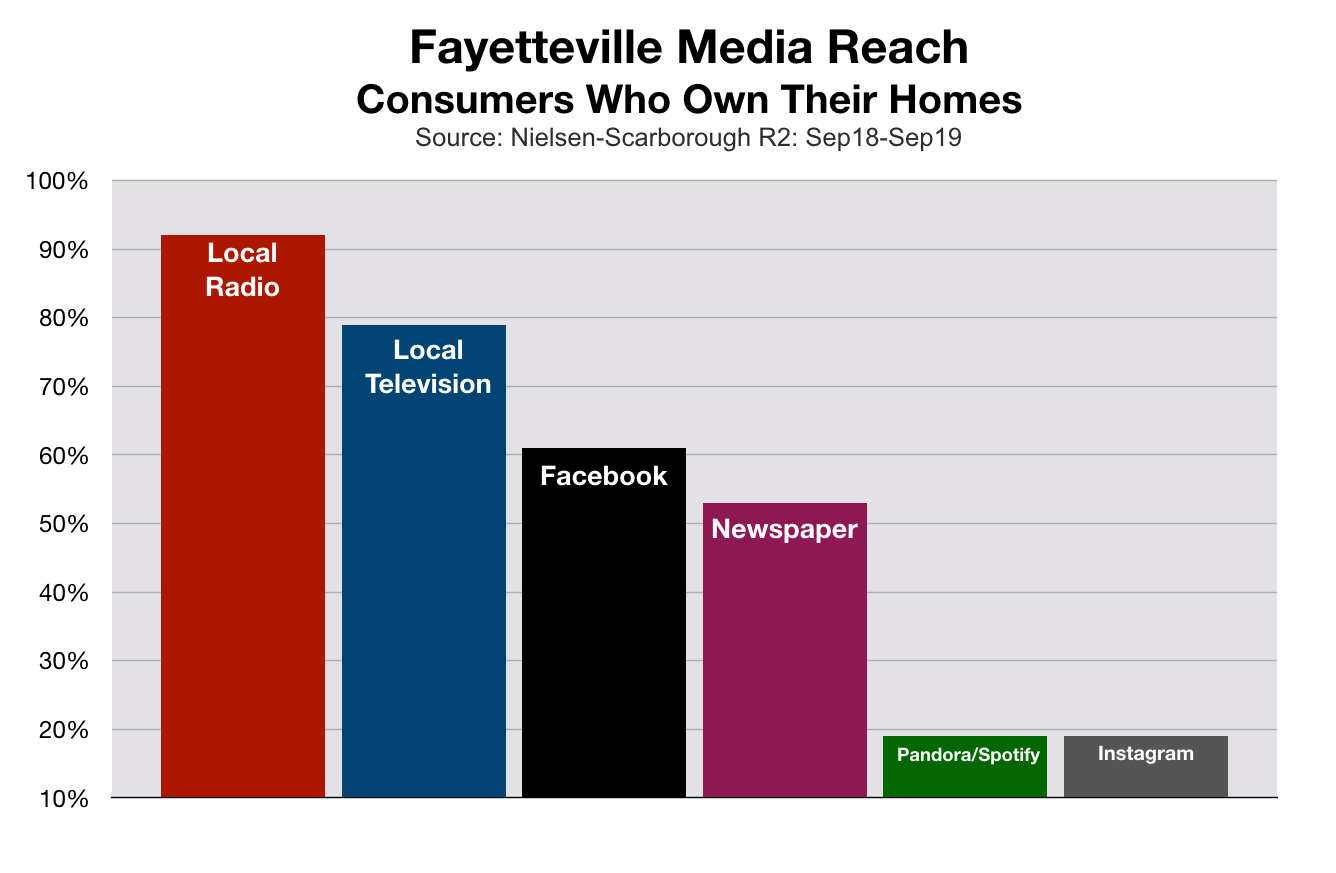

Every week, 92.9% of consumers who own their homes tune-in to a Fayetteville radio station. This is significantly more than are reached by local TV, newspaper, social media, or streaming audio sites like Pandora and Spotify.

Every week, 92.9% of consumers who own their homes tune-in to a Fayetteville radio station. This is significantly more than are reached by local TV, newspaper, social media, or streaming audio sites like Pandora and Spotify.

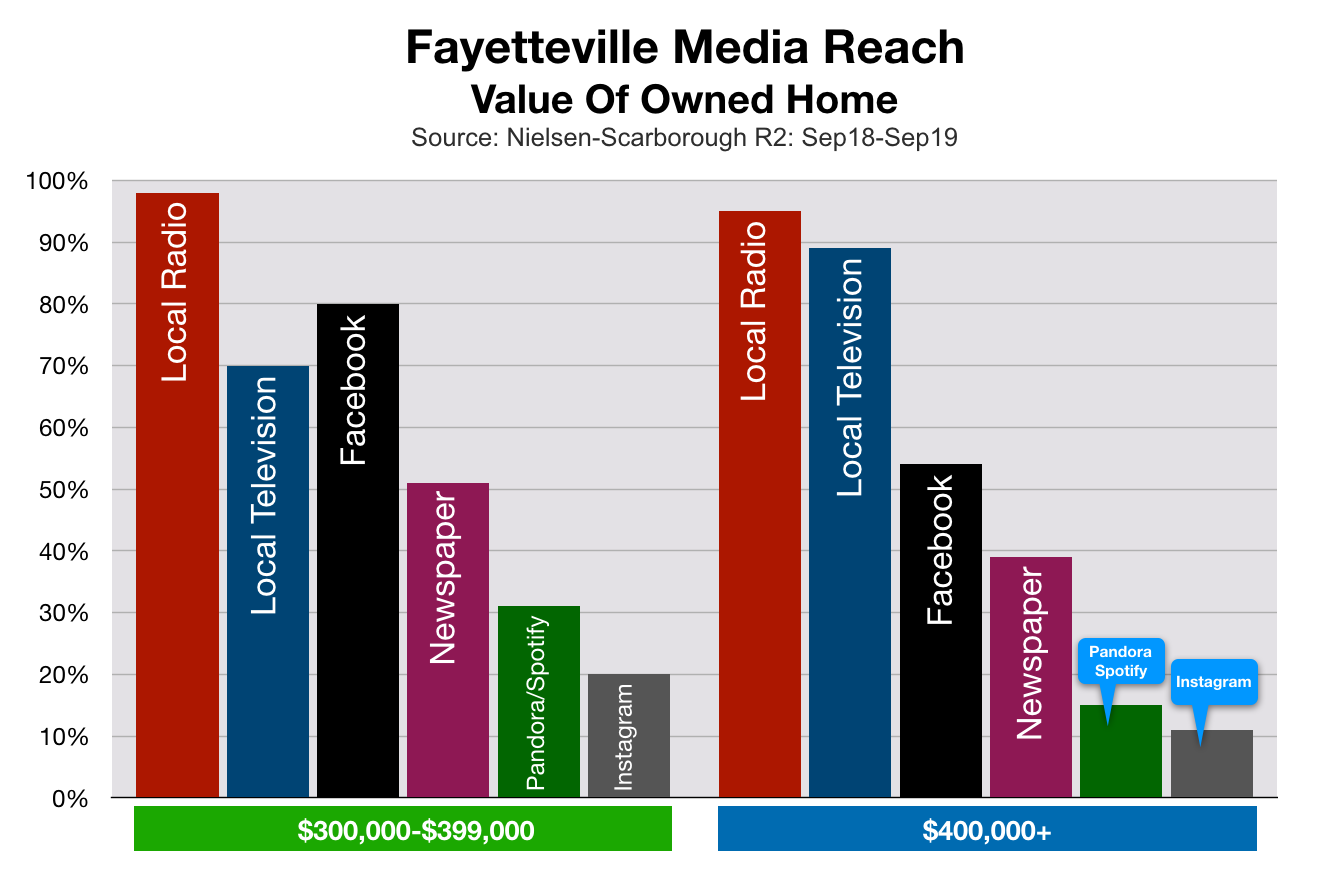

The refinancing fees charged by most lenders and brokers are based on the size of the new mortgage. Advertising on Fayetteville radio also has the greatest reach among owners whose homes have the greatest value.If a consumer Googles 'refinance my mortgage in Fayetteville', more than 2.6 million results come back, So, to set themselves apart, lenders and brokers will need to advertise. By any key metric, advertising on local radio is the best way to reach area homeowners.

To avoid missing out on the fees the current refinancing boom is creating, North Carolina lenders and brokers need to advertise now.

Business news network CNBC reports, "Phones are ringing off the hook at lenders like Quicken, which had a couple of record volume days this week, according to the company’s CEO. While mortgage rates now hover around record lows, they are seeing some push-back to go much lower. That is because lenders are so overwhelmed by the volume, they are simply too busy to lower rates."

More Advertising Advice For Fayetteville Small Business Owners

- Small Business Advertising In Fayetteville: Target The Spenders

- Fayetteville Retail Boom: How Your Small Business Can Benefit

- Advertising on Fayetteville Area Television vs. Local Radio

- Best Way To Reach Millennial Parents In Fayetteville

- Why Fayetteville Used Car Dealers Need To Advertise Now

- Advertising In Fayetteville: Reach Mother's Day Shoppers